|

Report #4:

Community Economic Development Organizations & Their Financial Health

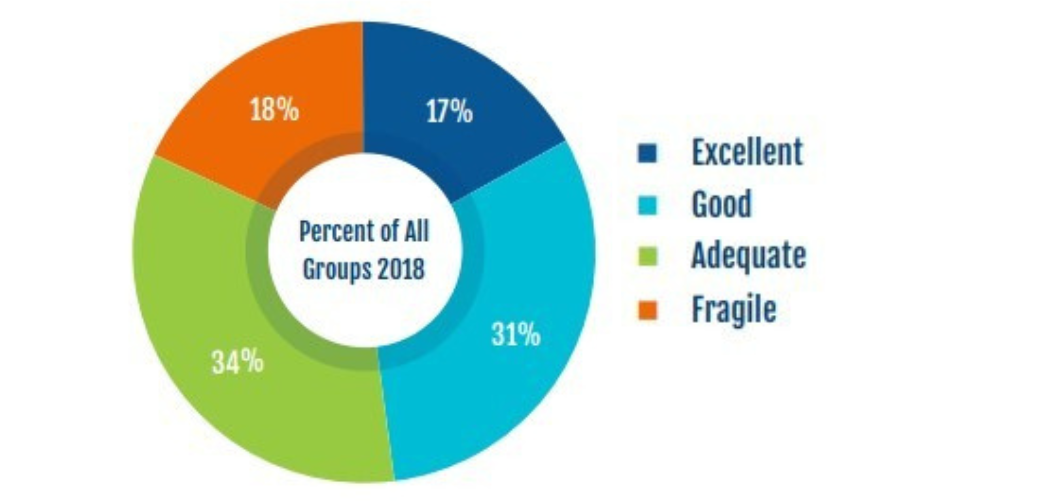

Community Economic Development Organizations & Their Financial Health is the fourth report in the Money Meet Community series. For the first time in the history of our field, we have a definitive statement on the financial health of community development organizations nationwide, The report finds 82 percent are in adequate-to-excellent financial health. That holds largely true for organizations of all sizes.

The innovative methodology was created by authors Kevin Morris, senior vice president of NeighborWorks America, and research consultant Chris Walker. With the Alliance’s support, the authors adapted an evaluation process used by NeighborWorks America to assess the financial health of their network to create a new tool for assessing financial health of the community development field nationally. The community development field channels over $25 billion in revenue annually to provide affordable housing, support small businesses, and deliver essential services to disinvested communities.

Recommendations:

Provide operational support. Increase flows of reliable core-operating support, invest in technical support, and provide flexible, low-cost capital to strengthen organizations’ financial health.

Bolster smaller organizations. Support smaller groups’ financial health to ensure an equitable distribution of community development efforts throughout the United States.

Develop the national network of intermediaries. Cultivate groups dedicated to increasing the stability and productivity of community developers to improve the sector’s financial health.

Financial Health

Nonprofit Community Development Organizations

The third brief in the series, Community Economic Development Organizations, Geography & Financial Resources, analyzes how resources and community economic development organizations are distributed across the United States.

|